Northwest Natural’s Criticism of HB 2020: Misleading, Lacks Context

Posted on March 8, 2019 by Bob Jenks

Tags, Energy

As the legislature considers HB 2020 to institute a declining cap on carbon emissions, Northwest Natural (NWN) has become a leading critic of the current bill. Northwest Natural’s criticisms lack context and paint a picture that is scarier than reality.

Natural gas is a commodity sold on the wholesale market. The commodity cost currently represents about 20 percent of residential rates. When NWN buys the commodity, it must also purchase capacity in interstate pipelines in order to deliver the gas to Oregon. Additionally, NWN rates and customer bills include the cost of building and maintaining a distribution system within its Oregon service territory to get the gas to homes and businesses; the cost of metering and billing customers; and a wide range of other services ranging from contractor referrals to energy efficiency system improvements.

Considering the cost impacts of HB 2020 on natural gas customers, therefore, requires assessment of the following three factors:

- The wholesale commodity cost of natural gas, which is simply the cost of gas purchased at an out-of-state trading hub.

- The retail rate for natural gas, which includes the cost of interstate pipeline capacity needed to get the gas to Oregon, as well as the Oregon specific costs of NWN’s system and services. Rates are set so NWN can recover its costs and earn a return on its shareholder investments, but rates and bills are not the same because bills are based on how much natural gas each customer uses.

- Customer bills that reflect both the rate and how much gas is used. Residential customers primarily use natural gas for home heating; usage increases when it is cold and declines when winters are warmer. In other words, bills vary with weather even if rates are the same. Residential usage in Oregon has been declining because of energy efficiency investments.

Context that is missing from NWN’s analysis

Natural gas commodity costs are at historic lows

NWN recently sent out an email to business customers that stated:

businesses like yours could see a 40% increase (11 cents more per therm) for the cost of natural gas on the first day that the legislation goes into effect in 2021.

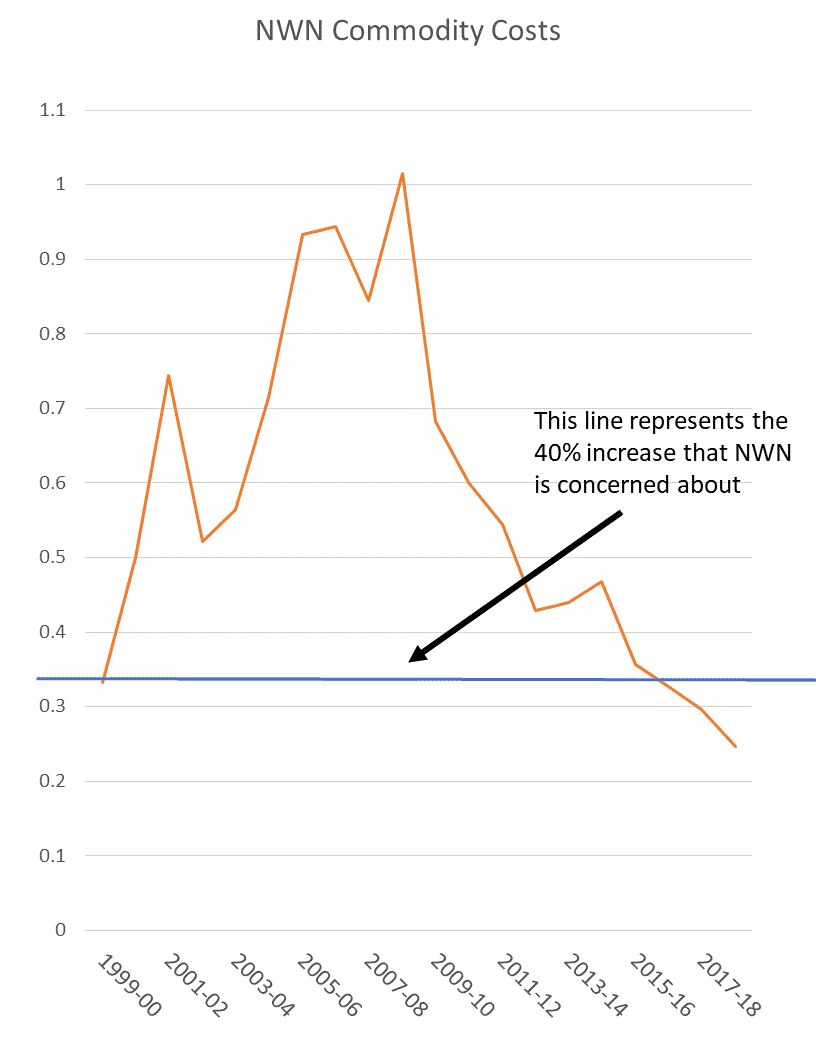

The blue line on the graph below shows what a 40 percent increase in the commodity cost of gas would do to NWN’s commodity costs. But NWN is talking about the commodity cost, not the retail rate and not the customer bill. Since the commodity cost comprises 20 percent of a residential customer’s bill, this does not mean that bill will go up 40 percent.

Even with this 40 percent natural gas commodity cost increase, the cost would still be below what it has been every year from 2000 through 2015 because natural gas commodity costs are at historic lows.

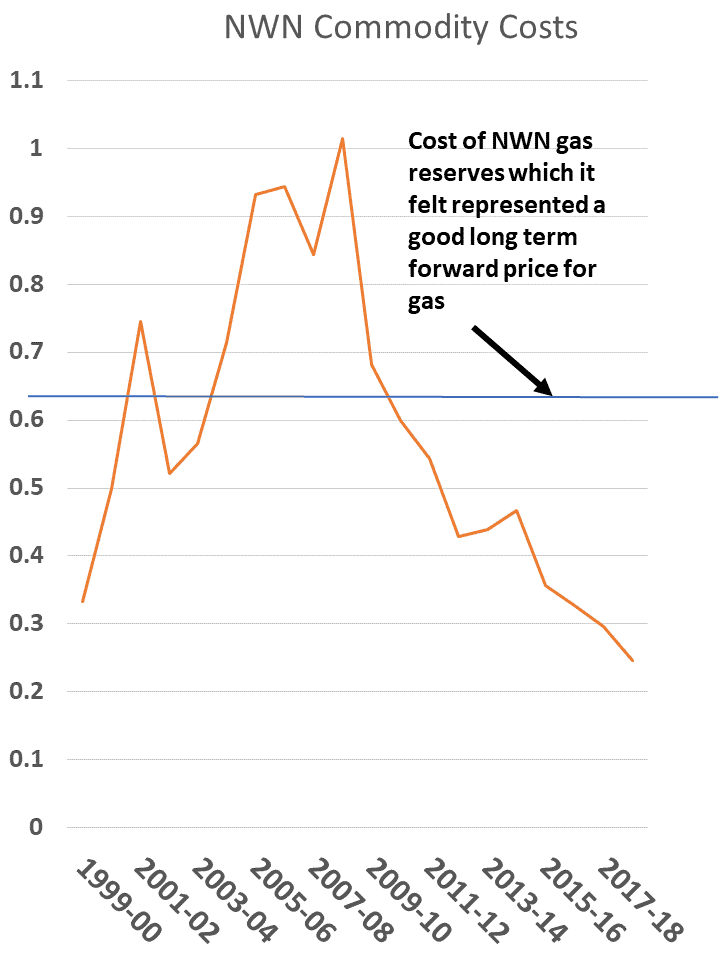

In fact, the commodity cost of gas is below what NWN thought possible even a few years ago. In 2011, NWN won approval of a plan where the company would invest in natural gas reserves in Wyoming and participate in drilling individual wells intended to produce gas for 30 years at a projected cost of 0.55 cents/therm (.63 cents/therm in 2019 dollars). In 2011 this made sense to NWN because they thought gas prices had fallen to a low point and were about to begin increasing. NWN even convinced CUB that the price of natural gas would be going up and that the gas reserves were reasonable. But the cost of gas kept falling. Current gas costs are less than half the price that in 2011 NW Natural wanted to commit to on an ongoing basis.

NWN has been planning for carbon costs for several years

Every two years, natural gas and electric utilities submit Integrated Resource Plans, or IRPs, which outline how the utility plans to meet its customer load over the next 20 years. Since 2011, NWN has been assuming that carbon emissions will be regulated and priced. In its 2011 IRP, NWN forecasted carbon costs beginning in 2014:

at $15/metric ton and reaching $50/metric ton in 2030.

In its 2014 IRP, NWN stated that it expected regulation that would add a price on carbon:

NW Natural’s Base Case forecast includes a price on carbon as the natural gas price forecast embedded in the Base Case forecast includes, on a supply basin spot price basis, a price associated with the carbon content of natural gas. NW Natural believes this forecast represents the most likely regulatory compliance future associated with CO2 emissions.

In its 2016 IRP, NWN found:

The policy future around carbon pricing is uncertain but NWN believes a price on carbon will be adopted at the state, regional or federal level within the planning horizon.

In its most recent 2018 IRP, NW Natural is clear that it expects Oregon to pass carbon legislation:

Carbon pricing is a key policy objective in Oregon and Washington, though the states are approaching it in different ways. Each state is committed to a serious conversation about carbon pricing in the next 12 months, and NW Natural fully expects to see a carbon price in our planning horizon.

Since 2011, NWN has projected and planned around a price on carbon. While its forecasts have varied with each IRP, the average of its expected base cases identifies a carbon price in 2021 of 10.4 cents per therm. This is nearly identical to the 11 cents per therm that NWN projects will be the impact of HB 2020.

NWN has been preparing for these costs

Not only has NWN been assuming carbon costs along the lines of HB 2020 since 2011, it has been taking explicit action to prepare for these costs. Specifically, these projected carbon costs have been incorporated into energy efficiency planning. Higher costs due to carbon regulation mean that more energy efficiency is cost effective, and NWN has been allowed to increase its investment in efficiency.

Energy efficiency reduces usage and therefore it lowers the bills of natural gas customers. Since NWN has already been increasing its investment in energy efficiency based on future carbon regulation, the impacts of HB 2020 are already partially addressed.

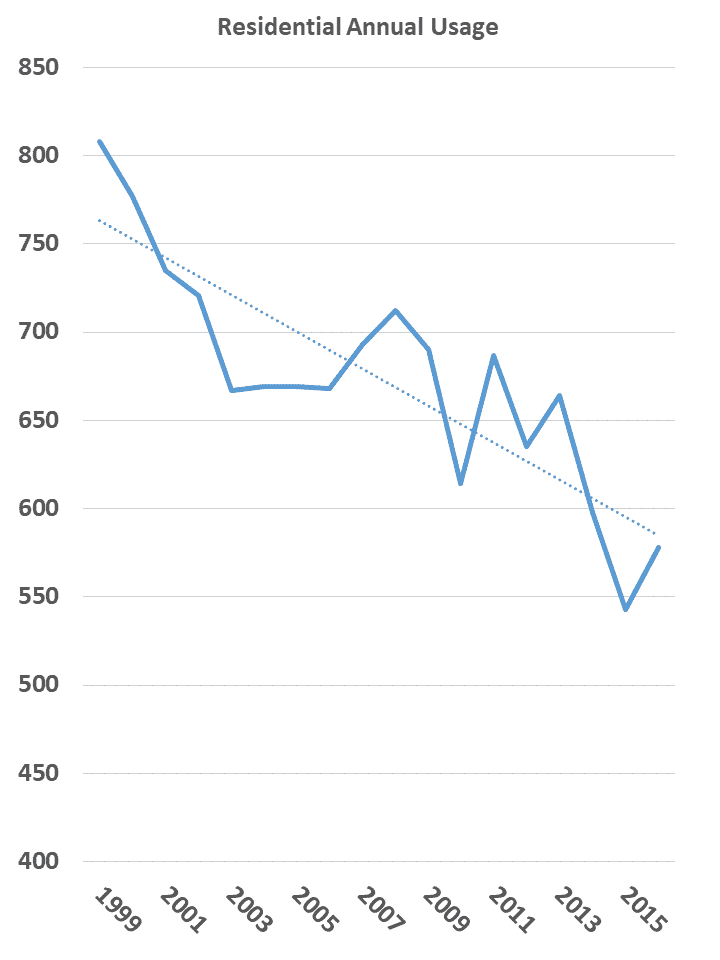

The above graph shows the overall downward trend in NWN customers’ residential usage of natural gas. While there is usage variability due to winter weather, the trendline clearly shows that NWN’s investments in energy efficiency are working.

NWN wants to be treated similar to electric utilities

NWN points out that HB 2020 directly supplies electric utilities with allowances that can be used to offset carbon costs, but that gas utilities are only being supplied with allowances for the purpose of protecting low income customers. But here is the rationale for this difference: Oregon’s major electric utilities must comply with legislatively adopted mandates to reduce carbon on their systems. Electric utilities are required to replace the coal in their systems, to invest more in renewable energy, and to acquire all cost-effective energy efficiency. NWN has no equivalent mandates. Electric utilities are spending billions of dollars under these mandates and customers are paying for these investments. HB 2020 recognizes these mandates and this electric utility spending. It allows the electric utilities to avoid having to purchase allowances if they can successfully decarbonize their systems beyond these mandates. If these electric utilities fail to successfully decarbonize, they will have to purchase allowances.

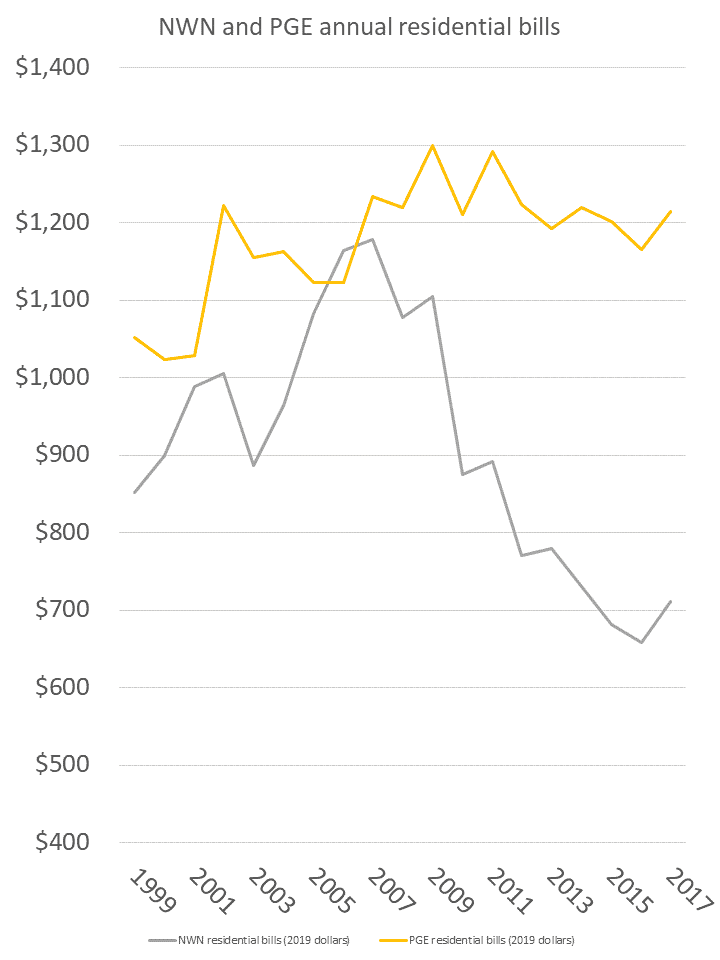

That NWN doesn’t face the mandates required of the major electric utilities is evident in its rates. As the commodity cost of natural gas has fallen, NWN rates and bills have fallen dramatically. To the extent that electric utilities use natural gas to produce electricity, this has helped electric customers, but this benefit is offset by the electric utilities’ mandated investments in coal phase-outs, new renewables, and energy efficiency.

The chart below compares residential bills for NWN and Portland General Electric, Oregon’s largest electric and gas utilities—this chart would be quite similar if NWN bills were compared to those of Pacific Power.

Lower costs for customers are a good thing, but the state must confront climate change

CUB has worked hard to lower bills for NWN customers. We challenged the company when it wanted to provide executives with thousands of dollars to remodel offices. We fought NWN’s attempt to earn a profit from managing its employees’ pension fund. We have opposed NWN’s proposals to increase its profit margin. We are a strong believer in keeping utility costs as affordable as possible for customers. At the same time, we have recognized that some costs are justified. CUB supported NWN’s plan to spend millions of dollars on replacing old pipe that could create safety issues. We want low rates. We want affordable bills. But we also want safe, reliable service.

Regarding HB 2020, we recognize that Oregon must address climate change. Natural gas is a fossil fuel and though less harmful than coal, burning natural gas still releases carbon emissions that are harming our planet. The effects are beginning to be felt in terms of droughts, wildfires, and hotter summers in Oregon – changes that have real impacts on the health and pocketbooks of utility customers.

As we place a cap on carbon emissions in the state, protecting utility customers is important. For gas utilities, HB 2020 focuses on protecting low income customers. CUB supports this focus, given that they are the most vulnerable to rate increases.

There is a need to address climate change and HB 2020 does that. Though there are other approaches, significant research and analysis has gone into legislative drafting of HB 2020 and CUB believes the bill is reasonable.

As the legislature debates HB 2020’s provisions regarding natural gas utilities, it is important to consider the context of commodity costs, rates, and usage. Natural gas commodity costs and average household usage of gas are both at historic lows. And Oregon’s gas utilities have been planning and preparing for carbon regulation since 2011.

Given this context, CUB finds NWN’s arguments unpersuasive. CUB supports HB 2020 and we encourage readers to “sign on” to our endorsement of the bill here.

To keep up with CUB, like us on Facebook and follow us on Twitter!

03/08/19 | 0 Comments | Northwest Natural’s Criticism of HB 2020: Misleading, Lacks Context