Forget Pandemic Impact - Pacific Power Wants More Money for Berkshire Hathaway

Posted on July 15, 2020 by Bob Jenks

Tags, Energy

Pacific Power filed its first general rate case in seven years back in February before the COVID-19 crisis. The company proposes to raise Oregon rates by $12 million to boost the profit margin of its corporate parent, Berkshire Hathaway. It’s clear that Pacific Power is more concerned about enriching its parent company than about COVID-19 impacts on its customers.

Pacific Power, with service territory in Oregon, Washington, and California, is the western half of the six-state PacifiCorp electric utility. Rocky Mountain Power is the other half, with service territory in Wyoming, Idaho, and Utah. PacifiCorp’s parent company is Berkshire Hathaway, which is run by the world’s fourth richest man, Warren Buffett.

In February, we outlined the initial Pacific Power rate increase proposal submitted to the Oregon Public Utility Commission (PUC). Since then, CUB filed comments in early June that came to a whopping 235 pages – illustrating our economic and legal analytical capacity - all devoted to protecting residential utility consumers. Our testimony highlighted the need for Pacific Power to revisit its initial rate case requests given the COVID-19 pandemic.

At the end of June, Pacific Power filed its reply testimony responding to comments from CUB and other intervenors. Pacific Power’s response was extremely disappointing, as the company maintained:

- Its request to boost profit margins for its Berkshire Hathaway shareholders,

- Its request to have customers protect shareholders from a bad investment on its Jim Bridger coal plant, and

- Its proposal to shift the economic risk of power cost forecasting from shareholders to customers.

CUB will continue to object to Pacific Power proposals that benefit shareholders rather than customers. Such proposals are incredibly tone deaf, given that hundreds of thousands of Oregonians have lost their jobs due to COVID-19, and that all indications are that the pandemic isn’t going away very soon.

Let me give you a preview of CUB’s rebuttal to Pacific Power’s reply testimony that emphasizes three concerns: higher profits, coal investment bailouts, and shifting economic risk away from shareholders.

Higher Profits

To start with, Pacific Power wants to raise rates by $12 million per year to provide greater profits to Berkshire Hathaway, its parent company.

Class A stock in Berkshire is priced at more than $300,000 per share. Utilities make profits by investing shareholder money and earning a return on that investment. What many of us think of as the authorized profit for a utility is established in the regulatory setting as the return on equity investment (the profit that the equity shareholder makes on their investment in the company) or just Return on Equity (ROE). Stated more simply: ROE equals Profit Margin. When a utility files for a general rate increase, the PUC examines capital markets and establishes an authorized ROE. Over the last decade, authorized returns have been declining. Currently, Pacific Power’s ROE is 9.8 percent—by contrast the ROE of Portland General Electric (PGE) is 9.5 percent. Pacific Power’s ROE would be lower, but it has not had a general rate case since 2013 when ROEs were generally higher. But Pacific Power and its shareholders are not satisfied with having a higher profit margin than other utilities; they want even more.

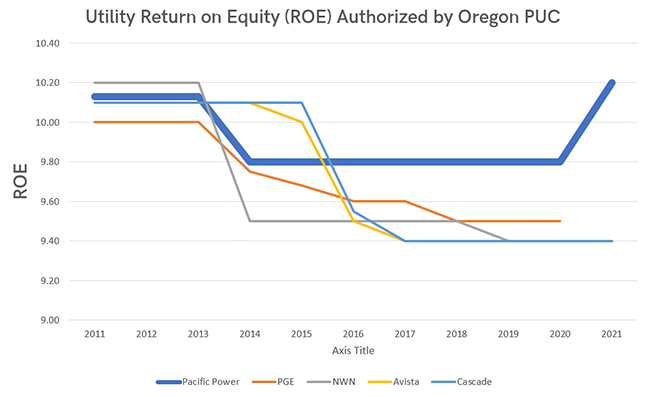

The below graph shows the ROEs of all the utilities regulated in Oregon that have had at least two rate cases to reset profits over the last decade. It shows that ROEs have been declining over this time period, and that Pacific Power’s current ROE is higher than the other utilities. It also shows, via the thick blue line sloping up at the far right, that Pacific Power is the only utility seeking to raise its profit margin next year.

This is in contrast to the three other utilities that also have rate cases before the PUC: Northwest Natural, Avista Utilities, and Cascade Natural Gas. All three of these utilities have requested to maintain their current 9.4 percent ROEs, which is why their gray, yellow, and thin blue lines are flat into the future in the graph. Only Pacific Power and its shareholders are seeking an increase in profits during the COVID-19 crisis.

Coal Investment Bailout

In its 2013 resource plan, Pacific Power proposed to invest hundreds of millions of dollars to retrofit two units of its Jim Bridger coal plant in Wyoming. CUB opposed this because the utility did not seriously consider avoiding the investment by committing to close the plant at a future date.

Back in 2013, the PUC declined to endorse Pacific Power’s Jim Bridger retrofit investment. But the resource planning process doesn’t allow the PUC to halt a project, and Pacific Power began the retrofit even though it was understood that this would lock the company into a 20-year commitment (the useful life of coal investments). Then, before the Bridger retrofit was completed, Oregon passed the coal-to-clean law in 2016 that required eliminating coal from Oregon rates by 2030.

The plan now is to remove the Jim Bridger plant from Oregon rates by 2025. However, Pacific Power is asking Oregon customers to help pay for this investment that CUB always insisted was avoidable. Even worse, in its 2021 rate case, Pacific Power proposes that its Oregon customers pay off most of the 20-year useful life of the investment in just the next five years.

This makes no sense. This investment was designed to extend the life of the coal plant, even as it was clear that Oregon was moving away from coal. All along, CUB opposed this Jim Bridger retrofit investment going into rates and instead insisted that shareholders pick up the tab. Our position was reinforced when the PUC declined to approve the investment, a decision that signaled their view that shareholders were at risk for the investment.

The bottom line is that Pacific Power took a risk on behalf of its Berkshire Hathaway shareholders. It failed to listen to CUB’s warning. It believed that investing in coal plants was a good thing for customers. As it turns out, CUB was right. This was not a good investment and Berkshire Hathaway should absorb the cost of this misguided coal plant retrofit.

Shifting Economic Risk Away From Shareholders

Utility rates are traditionally set based on forecasts. We forecast everything from the price of natural gas, to the cost of health insurance for utility employees, to the expected number of electric vehicles that will provide utility revenue. Forecasting is a challenge and can never fully predict the future.

Currently, Oregon allows a set of costs, called net power costs (fuel, wholesale power prices, customer load) to be trued up if the forecast is significantly off and if the utility has been under- or over-earning by a large amount. Pacific Power wants to change the rules so the true-up would happen automatically, regardless of earnings.

The purpose of this proposal is to shift the economic risk of forecasts from shareholders to customers. If this approach were currently in place, Pacific Power would be adding a $45 million surcharge to customers’ bills to make up for errors in last year’s power cost forecast. But in 2019 the utility earned 10 percent ROE, which was above the authorized ROE of 9.8 percent. So, even though the net power forecast was off, Warren Buffet and other Berkshire Hathaway shareholders still earned their expected profits.

But they want more.

In the middle of a pandemic.

When thousands of customers’ jobs have been sacrificed for public health.

They want more.

CUB will continue to object! Stay tuned for updates on this and other rate cases as CUB fights for your customer interests in the coming months.

To keep up with CUB, like us on Facebook and follow us on Twitter!

07/16/20 | 1 Comment | Forget Pandemic Impact - Pacific Power Wants More Money for Berkshire Hathaway