CUB’s Comments on Pacific Power’s Integrated Resource Plan

Posted on September 5, 2013 by Nadine Hanhan

Tags, Generation, Transmission, Distribution, Utility Regulation

On August 22, CUB submitted its comments to the Public Utility Commission (PUC) on Pacific Power’s 2013 Integrated Resource Plan (IRP). An IRP is a document that outlines how a utility intends to meet its resource needs in a least-cost/least-risk manner over an upcoming 20-year period. In the IRP, the utility compares the results of various combinations—or “resource portfolios”—of potential resources (wind, coal, gas, energy efficiency, etc.) to determine which resource portfolio is the least cost/least risk path to meeting the demand of the utility’s customers. The Commission “acknowledges” IRPs if they satisfy various conditions, but acknowledgment does not equal pre-approval of a utility’s integrated resource plan. Acknowledgment simply means the plan seems reasonable at a given point in time. Circumstances are constantly changing, and a utility is expected to respond to changing events and circumstances. For this reason, an IRP can only show a snapshot of what a utility is planning at a particular point in time, and they must be redone every two years. In CUB’s comments, CUB focuses on three areas of Pacific Power’s 2013 IRP: energy efficiency, Pacific Power’s analysis on coal, and its transmission modeling. Below is a summary of these issues.

Energy Efficiency

CUB’s primary concern is that Pacific Power is not planning to invest enough in energy efficiency even though its modeling shows that it is the cheapest resource. In earlier stages of the IRP process, the Company’s modeling demonstrated that including additional energy efficiency investments would reduce the overall cost of meeting customer loads. Some resource portfolios included “ramped up” or accelerated energy efficiency investments, and these accelerated scenarios proved to be among the highest ranked—or lowest cost—of any of the other portfolios. However, the Company decided not to pursue these low-cost scenarios because it argued that it did not know whether it could carry out the “ramped up” energy efficiency. CUB disagrees with this because in its own IRP report, Pacific Power recognizes that it surpassed its own energy efficiency goals two years in a row (both in 2011 and 2012) by a substantial margin (29% or 845,036 MWh – that’s a lot!).

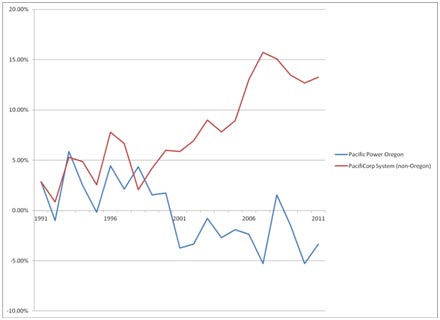

In addition, in Oregon, energy efficiency investments are overseen by the Energy Trust of Oregon (ETO). It is through the ETO that energy efficiency investments are made for Oregon’s largest electric and gas utilities. Since 1991, Oregon has experienced a decreasing trend of electricity use for average families, while on a national level electric use has increased. At the same time, Pacific Power has been investing more money in Oregon for energy efficiency through the ETO than it has in the other states and has been achieving greater results.

CUB believes that Pacific Power should look to both its own modeling results and Oregon’s ETO programs to make a more concentrated effort in pursuing an accelerated energy efficiency scenario. Because Pacific Power did not select the least-cost accelerated energy efficiency scenario, CUB asked the Commission not to acknowledge the energy efficiency portion of Pacific Power’s IRP.

Coal

In its draft IRP, Pacific Power proposes to move forward with hundreds of millions of dollars in investments on its fleet of 26 coal plants. CUB is concerned that Pacific Power’s approach to coal investments could lead to customers paying huge sums of money to retrofit coal plants that are then shut down due to future climate regulation. In particular, CUB is concerned with three main problems with PacifiCorp’s coal analysis:

1. The parameters that the Company used to model investments to its coal plants to meet Regional Haze Rules were too narrow to evaluate the expected costs.

2. The economic lives of clean air investments that the Company used were not consistent with the economic lives of the plants, and this could lead to overinvestment in coal plants.

3. In looking at alternative closures (what CUB refers to as phase-outs), the Company misapplied the Environmental Protection Agency’s (EPA) cost-effectiveness limit.

First, Regional Haze Rules (RHR) are put into place by the EPA and outline how a company should improve visibility caused by air pollution. There are certain investments that companies must make in order to comply with these rules, but companies are also required to do analysis to make sure that their investments are also cost-effective. The Company must submit a plan outlining these investments, called a State Implementation Plan (SIP), to the state where the plant is located. That plan must be approved or rejected by both the state’s Department of Environmental Quality (DEQ) and the federal EPA. The SIP approved by Wyoming for Pacific Power’s coal plants was rejected by the EPA, so the EPA issued a draft of a Federal Implementation Plan that would require Pacific Power to make additional investments in its coal plants. The proposed requirements of the federal EPA go beyond what Pacific Power considered in the IRP, including the stringent case that Pacific Power modeled in case EPA would have rejected the Wyoming SIP. This leaves the IRP with no portfolios that have analyzed the hundreds of millions of dollars in investment that Pacific Power is likely to be required to make if it wants to continue running its coal fleet indefinitely.

Second, Pacific Power’s pollution control investments have expected useful lives of 20 years, even though some of the coal plants receiving the pollution control are expected to be closed before that time period is up. CUB’s comments point out that Pacific Power could have matched up the useful life of the pollution control to be identical to the coal plant, which under EPA rules would have reduced the cost of pollution control. This approach would have required Pacific Power to commit to closing the coal plants at the end of their current expected useful lives. Pacific Power is unwilling to do so. Instead, it is overinvesting in pollution control with the hope that it will later be allowed to extend the lives of its coal plants. With utilities all across the country beginning to phase out coal plants early this seems like it is based on hope rather than good economics.

Lastly, as part of Pacific Power’s IRP, the Company modeled the cost-effectiveness of phasing out a coal plant early as opposed to just installing pollution control to run the plant for a few more years. While CUB believes that this is moving in the right direction, CUB still has issues with the way the Company has chosen to do this modeling. Pollution control costs are measured by the EPA in dollars per ton of pollution removed (e.g., $xxxx/ton). CUB believes that the number selected by Pacific Power to do its modeling was not reasonable. As a result, Pacific Power failed to meet its burden of proof to show that the investments it made were indeed least-cost. For this reason, CUB also asked that the Commission not acknowledge the Company’s coal study.

Transmission

In addition to energy efficiency and coal investments, CUB also took issue with certain elements of Pacific Power’s transmission analysis. The Company made an ambiguous assumption about the potential of a certain transmission investment and used it to justify a multi-million dollar project. CUB critiques the analysis for the Company’s reliance on an arbitrary assumption regarding reliability. The Company assumes that if the transmission project is not built, there will be a single catastrophic outage on its system over the next 20 years. However, if the project is built, the Company assumes that there will not be a single catastrophic outage. Pacific Power offers little basis for this assumption, yet this assumption provides all of the net benefits of the project. There needs to be a more concrete method for calculating the potential benefits of a large transmission segment. CUB also asked that the Commission not acknowledge this portion of the IRP.

CUB is happy to participate in the public process, and while CUB does believe that the Company is moving in the right direction, there are several issues in the 2013 IRP that require more investigation. CUB will continue to fight to make sure that customers’ best interests are being represented.

To keep up with CUB, like us on Facebook and follow us on Twitter!

04/04/17 | 0 Comments | CUB’s Comments on Pacific Power’s Integrated Resource Plan